Types of Investment Risk: Interest Rate Risk

Published on June 24, 2013

We are in the middle of a series breaking down the various types of investment risks. You can read the introduction here. We are posting one article covering one risk each weekday until the series is complete.

Last Friday we covered Natural Disaster, and today we are covering...

Risk #11: Interest Rate Risk

Description: Many investments benefit from reduced borrowing costs. When interest rates rise substantially (thus increasing borrowing costs) this can reduce profit margins and net cash flows for many types of investments. For fixed income investments, rising interest rates can significantly reduce the demand for investments that provide lower rates of return, thus reducing their value substantially. Why buy an existing 3% bond if you can buy a new 5% bond? The owner of the existing 3% bond would have to sell at a discount given the higher competitive bond rates, or hold to maturity and be subject to a lower rate of return.

Primarily Applies to... All investments that depend directly or indirectly on lower interest rates are subject to this risk, though to a greater degree with investments that have financing (i.e. liabilities due) that is maturing in the shorter-term or bonds (debt-related assets held for investment) that are maturing in the long-term.

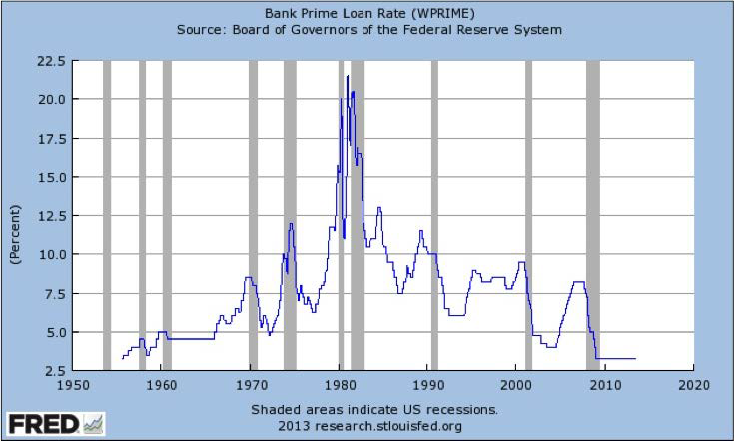

Real World Examples: Interest rate hikes in the 1980s to fight inflation and rising rates popping the housing bubble in 2005-2008 are primary examples of interest rates directly impacting the economy and asset values.

Extreme Avoidance Measure: Don't make investments that are directly or indirectly affected by interest rates.

Potential Mitigations: Avoid shorter-term or variable rate debt--or debt that is not matched up with the exit strategy of an investment. When using financing, choose long-term fixed rate financing that is not subject to interest rate fluctuations for long-periods of time. Avoid overly leveraged investments and fixed-income investments that depend on lower rates to maintain demand.

Stay tuned, tomorrow's highlighted risk is: Reinvestment Risk.