Types of Investment Risk: Inflation

Published on June 10, 2013

Welcome to Our Series on Investment Risks

Over the next week and a half we will be breaking down the various types of investment risks. We will be posting one article covering one risk each weekday until the series is complete.

The reality is that there is absolutely no such thing as a risk-free investment. Anyone who tells you otherwise is lying or does not understand risk. The question is never about whether you are going to take on risk, but rather which risks are you willing to take with your wealth and how you will manage, and attempt to mitigate, those risks along the way. This series provides a brief description for most of the major risks that investors face. Each risk profile will highlight real world examples, extreme measures to avoid the risk altogether (if possible), and reasonable potential mitigations to address the risks that all investors face.

The reality is that there is absolutely no such thing as a risk-free investment. Anyone who tells you otherwise is lying or does not understand risk. The question is never about whether you are going to take on risk, but rather which risks are you willing to take with your wealth and how you will manage, and attempt to mitigate, those risks along the way. This series provides a brief description for most of the major risks that investors face. Each risk profile will highlight real world examples, extreme measures to avoid the risk altogether (if possible), and reasonable potential mitigations to address the risks that all investors face.

Today we are covering...

Risk #1: Inflation

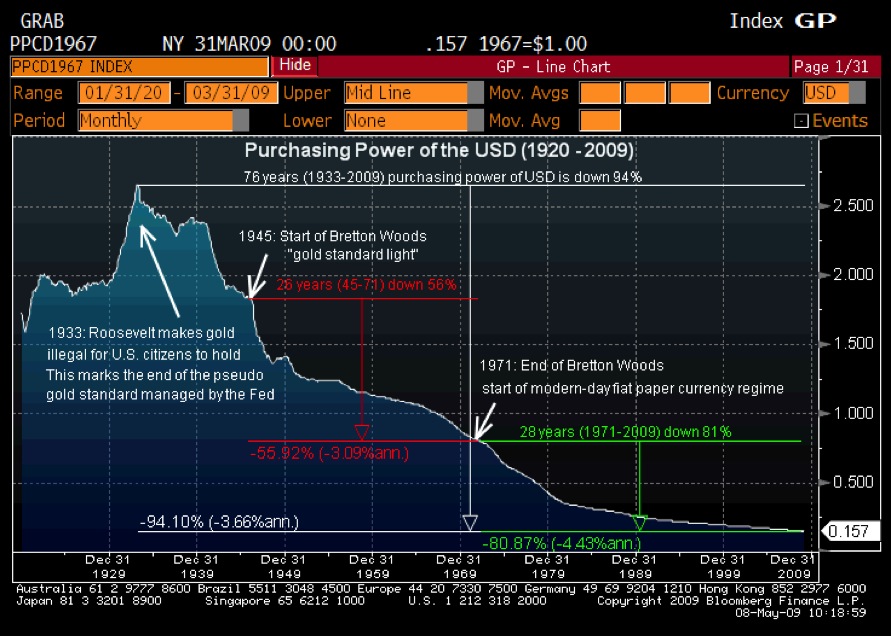

Description: Inflation is the devaluation of a currency through expansion of a nation's money supply. As the actively used portion of the money supply grows, buying power decreases, and it takes more of the same currency to buy the same goods. Therefore, if investors hold cash/low return savings through an inflationary period and if the return on the cash/savings is not sufficient to offset the effects of inflation, then the investor is ultimately left with a real loss of buying power and wealth.

Primarily Applies to... Currencies, CDs, cash, savings accounts, money market funds, fixed rate bonds, and any investment that has a low, long-term fixed income.

Real World Examples: Extremes: Weimar Republic and Zimbabwe faced hyperinflation and the currency was essentially worthless by the end. Just about all fiat currencies are devalued over the long run (e.g. Coca-Cola costs a bit more than a nickel lately).

(Buying a loaf of bread in the Weimar Republic, circa 1921)

Extreme Avoidance Measures: Avoid long-term fixed income investments that pay a lower level of return. Invest all of your capital into inflation-hedged investments such as real estate, commodities, floating rate debt, tangible assets, etc.

Potential Mitigations: Maintain only enough capital to cover living expenses without income for a 6-12 month period. Diversify the remaining portion of capital over liquid, semi-liquid, and illiquid investments that provide a hedge against inflation.

Stay tuned, tomorrow's highlighted risk is: Illiquidity.