Types of Investment Risk: Government Regulation/Taxation

Published on June 18, 2013

We are in the middle of a series breaking down the various types of investment risks. You can read the introduction here. We are posting one article covering one risk each weekday until the series is complete.

Yesterday we covered Environmental, and today we are covering...

Risk #7: Government Regulation/Taxation

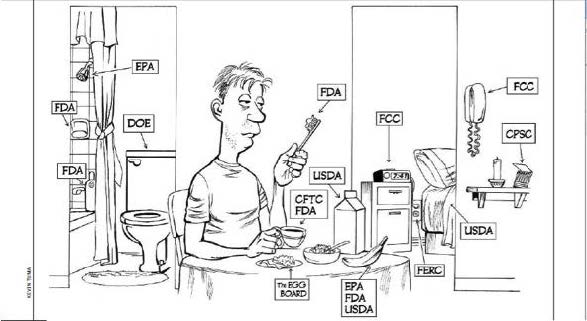

Description: Changes in government regulation and taxation impacts investments. If an investment depends on certain tax subsidies that are later removed, the value assigned to that particular investment may be wiped out. If a government regulation increases the expense of producing certain products, a company's profit margin might be reduced dramatically, thereby impacting the potential earnings and stock value. Since much in the way of commerce and business is built upon widely recognized legal constructs, shifts in those legal constructs can have many consequences for all types of investments (both intended and unintended).

Primarily Applies to... All investments are potentially subject to this risk.

Real World Examples: One of the most famous government changes that had a major impact on the investment world was the Tax Reform Act of 1986, which dramatically affected the tax treatment of limited partnerships that were formed primarily for the purpose of tax shelter and write-offs. Many of the partnerships that had been formed for their tax advantages rather than their inherent profitability became essentially worthless after this law passed.

Extreme Avoidance Measures: Start your own country. Other than that, sorry--nothing you can do here to entirely avoid this risk. Cyprus just had a portion of their savings disappear overnight based on the European Union's demand and just about every country on the face of the planet is in a race to devalue their currency (aka make the money you have saved worth less) so that they can afford their debts.

Potential Mitigations: Invest in assets that have long-established tax and legal precedent and that are deeply ingrained in the inter-workings of the economy. Avoid less established tax benefits that risk being taken away when budgets are squeezed. Generally, attempt to invest in the same general areas in which congress has personally invested as they are less likely to pass laws that will materially impact their own portfolios.

Stay tuned, tomorrow's highlighted risk is: Macroeconomic Risk.