Dancing--Nay, Sliding Down the Edge of a Cliff

Published on June 27, 2010

Before jumping into the content of this current newsletter, I would like to make a couple of important points regarding the stock market warnings in our last letter. In early May, I warned of a large market fall--right before one of the most significant single stock market drops in history. First, with respect to the timing, I certainly would love to claim genius or ownership over some proprietary market-timing crystal ball; however, it was simply a bit of luck and eerie timing. Though I did anticipate a large market fall, I did not necessarily foresee one of the largest market drops of all time in one day. Moreover, as my wife would point out, I am seldom early and barely on time. So, any delusions of grandeur aside, the probabilities are fairly slim that, in this case, I happened to get it that right.

Second, and more to the point, I do not believe that the violent drop that occurred in May accounts for the total market losses that will be suffered over the next several years. Indeed, I wish that the market fall I had originally referenced had already come and gone that quickly, but I believe that the awful drop we experienced was just a down payment on much greater market turmoil to come. Bottom Line: I would not change the sentiment or warning of the last letter one bit. I encourage clients to utilize any temporary market rally to make a more elegant exit from equities at this time. If one must remain exposed to the markets, it is imperative that you utilize defensive puts, tight stops, or insurance to protect your downside. Nothing has materially changed to reduce the overvalued condition or elevated risks that accompany most stocks and mutual funds right now.

The appropriate risk-to-reward investments will be found elsewhere until the underlying economy improves enough to justify the price of stocks or until the price of stocks declines to match the underlying realties of the economy...but this is merely my bias and current conclusion. In keeping with our typical model, the rest of this letter is reserved for the analysts, engineers, financial nerds, or simply curious. In this letter, we will discuss the ongoing battle between deflation and the Federal Reserve, odds of another recession, market timing, general forecasts of where I believe the major markets, currencies, and commodities will be over the next several years, and what we are doing to position ourselves to take advantage of these market moves. Get out the popcorn.

The Federal Reserve vs. Deflation: Who Will Win?

While the vast majority of economists and pundits espouse fears of inflation around the corner, the battle between the Federal Reserve and deflation rages on. Most people and even many economists do not understand the underlying cause of deflation and therefore are unable to recognize its presence, let alone predict its effects ahead of time. This is quite forgivable, as the past 70 years or so have been dominated primarily by inflation. Most people who debate the issue (including yours truly) have not lived through a period of extended deflation (i.e., the Great Depression) and thus are handicapped in recognizing the underlying forces that drive it. However, getting it right in this particular area of debate is no small matter--it is truly the difference between tremendous wealth-building opportunity and devastating wealth-destroying losses. (For a more in-depth discussion of inflation vs. deflation, please request our last two newsletters.)

I have spent considerable time discussing my view that deflation is a greater threat than inflation on the near horizon. I also discussed in the most recent newsletter the impact that deflation will have on most of the major markets (and, as promised, I will define my positions more precisely a bit later in this letter). So let's explore the arguments on both sides to see whether our views line up with reality.

Keep in mind for these arguments that deflation is a contraction in the money supply; inflation is an expansion in the money supply. In the corner for inflation are those who believe that deflation is impossible so long as the Federal Reserve exists and is able to control monetary policy. Since the Federal Reserve is actively opposed to deflation and has made it clear that outright inflation is to be expected and even pursued as a direct policy, how could anyone worry about deflation? With the flip of a few interest rate switches that the Federal Reserve directly controls, lending should pick back up, increase the money supply, and drive inflation ever higher. Moreover--and this is perhaps the strongest argument for inflation--if the Fed has the ability to create credit out of thin air (and it does), how could deflation even be possible? The Fed could just start the "printing presses," per se, and just like that increase the money supply. No more of that pesky deflation!

The unfortunate reality for these arguments is that this is exactly what the Fed has been doing. It dropped the Fed Funds Rate from 5.25% to just barely above 0%. This move generally has the effect of driving interest rates much lower, which"should" have had the effect of encouraging borrowing and thus furthering the expansion of the money supply. The Fed attempted to re-inflate bank balance sheets by lending billions of dollars at nearly 0% so that banks could make huge profits on the spread between their borrowing costs and the higher returns they could muster on any other investment. The Financial Accounting Standards Board redefined the meaning of "standards": The accounting rules were rewritten to allow banks to re-price deeply distressed assets as if they were not distressed at all. (This is tantamount to calling your bank to let them know that you decided to add some zeros onto your checking account balance and that you would be using the newly acquired funds to pay off your mortgage balance.) The Fed has also been very busy basically giving money away to banks through the full-price purchase of deeply distressed (a.k.a. "toxic") assets directly off the banks' balance sheets.

In addition to the efforts of the Federal Reserve, you should be excited to know that we taxpayers have been involuntarily privileged with the opportunity to get in on the reflation efforts. The Fed and Congress have used our savings and tax dollars to bail out banks, the FDIC, those who were not covered by FDIC limits, bankrupt insurers, those who were insured by the bankrupt insurers, car manufacturers, homeowners, home buyers, home builders, Fannie, Freddie, unemployment insurance, underfunded pensions, unions, state deficits, and, most recently, Europe, and Greece. I know that I am missing a few industries or governments in that list, but it's just so hard to keep track when we go on these shopping sprees and bailout bonanzas so often.

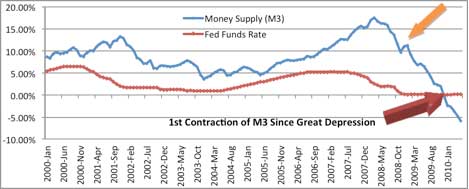

So, with all of the combined efforts of the Fed, Treasury,and Congress...each one spending, printing, and borrowing like there is no tomorrow...surely we would have caused the money supply to expand just a little bit over the last year and a half, right? Yet, as the chart in Figure 1 makes clear, all of these efforts have been to no avail. Figure 1 shows both the broadest measure of the money supply (M3) with the backdrop of the Federal Funds Rate (which is the primary rate controlled by the Federal Reserve and upon which many other important interest rates are based).

Figure 1

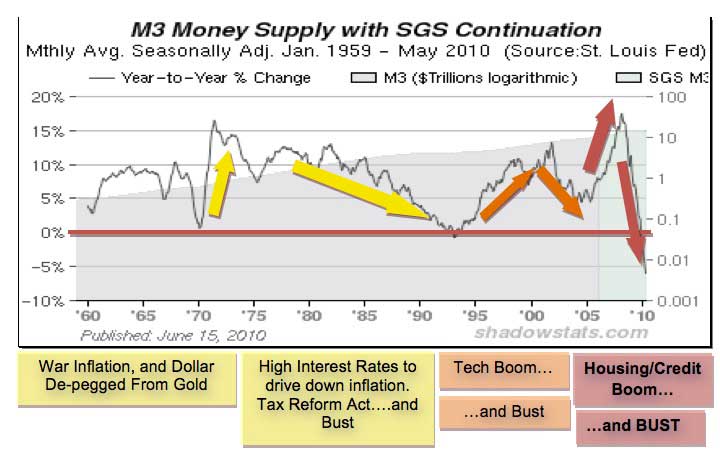

Despite all of the efforts of the Fed and U.S. government,including dropping the Fed Funds Rate to basically 0%, not only has money supply slowed in its growth--it has been outright contracting since the 3rd quarter of 2009. Just to put this into perspective, contraction of the money supply has not occurred similarly since the Great Depression. The chart in Figure 2 (please see next page) covers a longer history of the M3 measure of money supply throughout the worst slowdowns in growth since the Great Depression. In each previous cycle, note how credit has only slowed (dropping to 0% growth) but not contracted (dropping below 0%) until this past crisis.

Figure 2

This time, instead of bouncing at the point of contraction, credit destruction sliced through the combined efforts of the Federal Reserve, Treasury, and Congress to re-inflate the credit bubble. Though the Fed certainly influences money supply, it does not control it. Now that rates are basically already at 0%, what room does the Fed have to drop them lower? The Treasury has no reserves to draw from but instead is wholly dependent upon the Fed for its deficit funding. Congress could not even pass a bill to re-extend expired unemployment benefits this past week. Would they risk their political careers to attempt another, much larger stimulus? Even if they did manage to pass such a bill, will that new stimulus be any more effective than the past stimulus, which has done little to turn the tide of deflation? (As a side note: Be VERY concerned with what may be coming in terms of economic decline if they do muster the "courage" to pass potentially career-ending legislation. This goes against human nature without cause and is a sign that there is probably is cause, and thus, something greater to fear.)

At the end of the day, the reason why all of the stimulus efforts fail is that the money supply is much greater than all stimulus efforts combined. The U.S. Dollar denominated money supply is the sum total of trillions of dollars of credit among consumers, businesses, credit unions, banks, other financial institutions, and domestic and foreign governments. In all, the total money supply, including all outstanding credit and currency (of which only a small portion is physical dollars), is in excess of $50 trillion dollars. As massive as the total stimulus bill was ($787 billion), it was only a drop in the bucket (far less than 2% of the total money supply), compared to the total money supply. All told, we probably "created" about $2-3 trillion dollars in new money supply in our total stimulus efforts over the past year and a half...but still managed to have a net credit contraction of more than $2.5 trillion over the same period! This is deflation indeed, and it is quite doubtful that the Fed or anyone else will be able to stop it any time soon before it runs its course.

Double-Dip Recession?

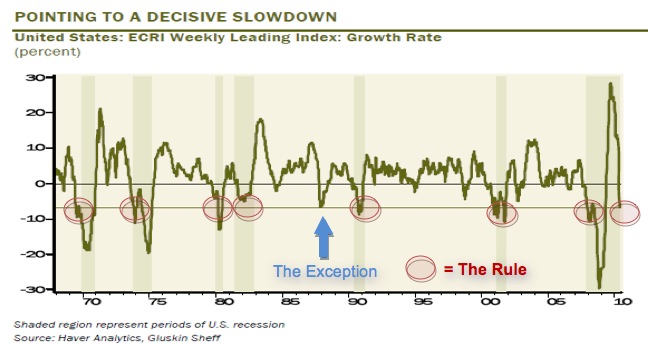

We have been labeling this current stock market rally (from March of 2009 to April 2010) a "bear market rally," and we have repeatedly claimed that this "recovery" is nothing more than a pause in a much greater economic decline. It seems that the leading economic indicators are catching up to our claims and pointing to a second helping of the recession from which we were apparently just recovering. With credit due to David Rosenberg for the insight, and as the chart in Figure 3 displays, we are in territory that begets a recession in just about every case.

Figure 3

Note that each of the gray bars running throughout the chart represents a period of recession. A drop to at least -5.7% in the weekly leading index accompanies every single recession in the past 40 years. The only time when these leading indicators dropped to -5.7% without accurately foretelling or accompanying a recession was back in 1987. Just for the record,we are currently sitting at -6.9%; as David Rosenberg aptly points out, unlike in 1987, we do not have room to lower rates any further. Who wants to make the bet that this time around is an exception to the rule? (As of the final edit of this letter, this index has now dropped to -7.7%, a level which has never been unaccompanied by a recession. Who would like to bet against those odds?)

The typical recession is accompanied by decline in the stock market of approximately 40%. Given that we face the largest tax increases in history in 2011, the inventory restocking cycle has just completed, states and cities are forced to cut staff and budgets, unemployment benefits have run out for 38 out of 50 states (and are beginning to expire without extension at the Federal level), housing is continuing to lag, and the stimulus spending is almost gone, we believe that the second dip of recession is a fairly easy call. This would line up perfectly with our research regarding the effects of deflation as it continues to works its way through every aspect of our economy. Now, the question turns to timing.

A Note on Market Timing

In response to our latest newsletter, I received numerous questions of timing with regard to reaching a bottom in stocks and a general bottom in the economic downturn. I have included the content of my response to one such client request, as I thought that both the question and response provided a rather apropos and logical next step for discussion of our present economic situation and its impact on investments in general.

The Question of Timing: With all of this talk of inflation, deflation, stock market crashes, double-dip recession, etc., it is natural to question the timing of such events. Talk of a market crash 5 years from now does little to deal with the interim period, and being that early in the correct assumption of a downturn is also known as being wrong on Wall Street. So how does one position a portfolio in the type of turbulent market we currently face? How do we get the right direction and also make sure that we are not missing out on the bottom of some of these distressed markets?

My response: I can certainly give you my best guess as to the timing with regard to the bottoming of the economy and certain sectors (and I will do so further below), but I propose that there is a much better way to consider portfolio positioning than time, in and of itself. We feel that our clients are best served when we analyze the extremes of human nature within the investment world (primarily reflected in actions/sentiment gauges of fear and greed). When we see euphoria or blind optimism abound in a particular sector or investment, we know that it is historically a good time to reduce, hedge, or eliminate exposure and look for a less "crowded trade." The more people who are convinced that they know "stocks are going up," "recovery has definitely started," "you can't go wrong with gold," etc., the less likely these extremes are to remain the case for very long...and then watch out below!

By the time the crowd has figured out the trade, the trade is over. The extreme highs in prices are reached in sync and are ultimately driven by the extremes of human sentiment/psychology. These optimistic sentiment extremes do not last indefinitely; thus, eventually, they lead to a reverse and decline in sentiment that causes a cascade into negative sentiment and falling prices. As with market highs and optimistic extremes, negative sentiment also reaches an extreme that tends to coincide with market bottoms.

Think through what occurred back in March of 2009 after the stock market violently plumbed depths in prices not seen for more than a decade. Sentiment had reached a negative extreme. Increasing numbers of economists were calling for a continued decline and the possibility of slipping into a technical depression. There was no hope to be found for stocks among the typical market cheerleaders and pundits who had been calling for the resumption of the bull market only 12 months prior. Now, hindsight being 20/20, we see that the majority of economists and pundits were bearish against stocks at the very low point of the recent temporary bottom in prices.

Only as the stock market began its tremendous rally that started in March of 2009 did we see most economists and market commentators begin to return to their optimism towards the markets. As the rally held, more people became convinced of the resumption of the bull market, and sentiment began to reach the extremes of the previous market highs. As we have pointed out before, these extremes are a contrarian indicator, and it was due primarily to these extremely optimistic reflections of sentiment that I was compelled to write the last newsletter warning of an impending market fall.

As always, people report high optimism that markets are headed higher...at the highs, and that they are headed lower...at the lows. This is the same as a weatherman's proclaiming that because it was raining during today's forecast, it shall rain henceforth and forevermore in the same general manner. He can point to the clouds, the puddles, the rain itself and make all kinds of intelligent-sounding arguments for why the rain will continue. However, upon returning the next day, the weatherman has found that the rain stopped. Of course, the evidence has changed dramatically. The clouds are gone, the puddles dried up, and there is not a drop in the sky. He can now confidently proclaim that sunny skies will be the defining feature of the weather moving forward--with plenty of evidence to boot...until the next time it rains.

As utterly nonsensical as this example is, it unfortunately marks the way both professional and retail investors react to and make decisions about the markets. If the market is cascading in a free fall, stocks are dead. If they tend to go up little by little for a couple of years in a row, don't miss out on Dow 50,000! Nonsense! And yet we all share these tendencies driven by the extremes of our emotions. It is of tremendous difficulty and yet, of utmost importance that we resist these natural tendencies if we plan to build and preserve our wealth.

As we have seen in recent market behavior, the switch from an optimistic to a pessimistic extreme can be very rapid and devastating. First, at or near the top, the crowd is restless in the extreme sentiment. Minor paranoia and fear start to set in as many individuals are simultaneously concerned that a top may be in; they do not want to be caught in a downturn. There have been numerous studies that people fear pain (read: "loss") four times more than they enjoy pleasure (read: "gain"). This tendency can lead to a violent turn in sentiment as people want to protect themselves from pain/losses more than continue in the gains. Selling pressure begins, which confirms the initial fears of a larger majority of shareholders, which then leads to more selling...which leads to more mass fear...and selling...and you get the idea.

This cascading effect does not happen in a straight line but in waves of emotion as investor sentiment shifts from the extremes of optimism to pessimism. By the time the bottom of a market is reached, the general investor thinks of the underlying investments as anathema--to be completely avoided. Unfortunately for most who do not understand the interaction of human emotion and investments, this is the EXACT worst point at which to sell the investments. Sentiment reaches an extreme that cannot be indefinitely sustained and then begins its long path back to optimistic extremes, bringing the underlying investments along with it. For the investors out there who can understand the extremes of emotion--and who have the discipline to act on them--there are tremendous opportunities.

So, all of that to say, it is not so much about timing as it is about watching the indicators that track sentiment in each investment sector. You want to wait until common headlines in the papers and magazines, the talking heads on television, and the common investor proclaims "Stocks are DEAD!" or "Real estate is hopeless!" or whatever else everyone is criticizing at the time. To be clear, we have not yet reached that point of negative extreme in most markets. In keeping with the swings of human emotion, as stocks, real estate, commodities, etc. potentially suffer extended declines after all of this optimism, you can bet that the crowd will be on the other side of the fence as it was back in March of 2009...and this will finally be a better point to buy back into these investments.

Currently, we are somewhere between guarded and unbridled optimism--close to another high in many markets. This is not the time to fear missing out on the next bull market. For those who are conservative and patient, this is the time to stand aside and wait for better prices with only a few exceptions that are discounted enough to take advantage of right now. For those who are aggressive, in addition to the few exceptions just mentioned,this is a good time to be adding positions that take advantage of shorting opportunities in certain markets or with certain weaker assets.

My best guess on timing and pricing for most major markets/assets is that the declines I outline below will resume within the next year and a half--and that they will continue in stair-step fashion (i.e., not straight down but down with pauses and rallies in between) for the next 4-5 years. I believe that we will see the economy bottom first somewhere between 2015 and 2016, and I believe that we will then begin to grow steadily from that point moving forward. I believe that we will face significant deflation throughout this period until we bottom. Interest rates may begin to climb a bit higher, but I believe that this will be a function of declining demand more than inflation. I do not believe that inflation will be a major concern until after we bottomed. However, due to the government's tendency to overshoot, I think that we may be in for some pretty terrible inflation down the road as the economy begins to recover. Thus, it is important to use the deflationary period to prepare for the inflationary one that will follow. Practically, this entails carefully building positions into discounted tangible assets that will benefit from inflation and provide income in the mean time.

That is my current position on timing the economy and markets in general, but so long as the government reserves the right to "change the rules," I reserve the right to change my position! My opinion on timing aside, I am much more focused on the extremes of sentiment. Timing is interesting and fun, but it is of no consequence if you cannot understand long-term valuation and mass changes in consumer sentiment. Ignoring valuation and the extremes of sentiment lands us right back at dancing on the edge of a cliff. It works until it doesn't...and then it doesn't, indeed. We currently believe that most markets are overvalued and that consumer sentiment reflects optimism that attends these overvalued conditions.These are dangerous times. If we notice changes in valuation or extremes occurring earlier, we will be prepared to call the bottom sooner--though I still do not believe this to be the case as of the writing of this letter.

Defining My Positions: Pricing & Timing of Individual Markets & Asset Classes

While future changes in the direction of social mood may alter the course of markets and thus my opinion of their potential, should deflation continue to take hold, this is my forecast for the following sectors:

Traditional Investments

Equities: With regard to stocks, mutual funds, and derivatives based upon these types of investments, I continue to expect the Dow to drop to at least 8500 and eventually even lower than 6500 (an 18-38% drop,respectively). I am currently very short on the markets and am not expecting to even consider picking up or recommending any long exposure to the stock market until we at least reach 8500-10,000. As I mentioned in the last letter, it seems that the market is disconnected from the underlying health (or lack thereof) of the majority of businesses and the consumers whose wallets fund those businesses. I believe that this would apply to both domestic and foreign equities, given the interconnectedness and interdependence of most major developed and developing economies. I do believe that foreign infrastructure equities for nations such as China and India make a lot of sense after a significant collapse of current market values. I expect that the risk of a major collapse is within the next few years.

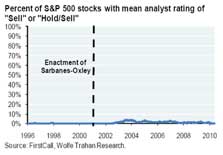

We do not specialize in specific equities recommendations, but we believe that we understand the basic tenets of value investing enough to know an overvalued market when we see it. That is not to say that there cannot be any undervalued investments in equities, but they are the exception and not the rule. Moreover, as is displayed in Figure 3, getting balanced equities advice is very difficult, today, as the majority of advisors/brokers tend to be permanent market cheerleaders, no matter where valuations are. As of May,approximately only 3% of S&P 500 securities have any sort of "Sell"recommendation from the major broker houses. Talk about extreme optimism!

Figure 4

Bonds: With regard to unsecured bonds, I tend to be agnostic of this particular area of the investment world unless dealing specifically with currencies/treasuries or investment-grade corporate debt. I know that there is money to be made in the speculative unsecured debt world, but I have always felt that human nature + the ability to default/bankrupt and walk away = way too much risk to bet that someone will fight human nature when times get tough--and this applies to corporations as well as governments, as they are both simply groups of humans in the aggregate. Moreover, with the current administration's taking a swipe at contract law recently with GM's bondholders, that particular part of the investment world is much less comfortable for me. That being said, while they are not as strong as secured options, certain discounted senior investment-grade corporate bonds may be worth considering, so long as the corporation has a strong balance sheet and is an industry leader.

On the other hand, I believe that discounted secured notes are the way to go in this particular category--especially in distressed times. If you can purchase highly discounted senior secured notes (1st mortgages or 1st lien positions) that are backed by tangible assets, this would probably be one of the more secure investments you can make in this environment. It is essential to make sure that your purchase and discount put you well below the intrinsic value of the asset to protect your downside.

As for prices, I will leave those to someone else and simply say that as times get tough and there are more "flights to safety," there will be more demand for secure streams of income from higher-credit-rated corporate and government bonds. I do believe that we will see Treasury Bond yields drop back below 3% as the economy worsens. This is a far cry from the direction that inflationists and hyperinflationists think bonds will go, but so long as deflation is the driving force, I am comfortable in this position.

Alternative Investments

Residential Real Estate: I do not see an initial sustainable bottom in the residential market, nationally speaking,until the fall or winter of 2011 at the earliest. That is not to say that money cannot be made in this area with significant discounts--but in general, you NEED significant discounts to protect from the downside risk. With the vast overhang of foreclosures, short sales, and finished, but unsold lots available on the markets, I do not foresee any near-term turn around in housing. I believe that the winters of 2011-2013 should provide outstanding opportunity for purchasing discounted residential real estate as both systemic and seasonal slowdown in buying volume should drive prices lower. Risk to opinion: unforeseen government meddling that is actually effective in sustaining an ongoing increase in residential home prices--so far, such meddling has only slowed but not reversed the inevitable. Government stimulus has simply served to encourage future buyers to buy sooner to take advantage of the tax credits of cheap financing. It did nothing to restart the industry,as evidenced by the fact that home sales fell off a cliff as soon as the tax credit expired. Bottom line: Regardless of timing, I think that you can and should wait to pick up assets or offerings that have targeted internal rates of return of at least 20% per year or higher in this sector. Anything less is not fully taking advantage of the weakness in this particular market. We expect declines of at least 15-20% from current prices, and we expect recovery to be painfully slow.

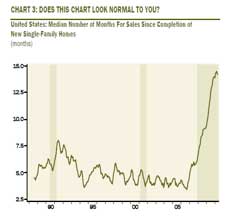

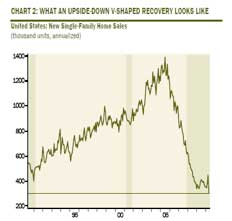

Take a look at the charts below to get a gauge of the housing "recovery" thus far (with credit again to David Rosenberg with Gluskin Sheff). The chart on the left shows the staggering drop in new single-family home sales. The chart on the right shows how many months a new single-family home sits on the market after development is completed. Both charts are dismal, given the massive amounts of stimulus the government has poured into this sector. (Note how new single-family home sales have dropped to a new low after the recent expiration of the tax credits.)

Figure 5

Commercial Real Estate: With one-off transactions or portfolio plays, I recommend only participating with 1) long-term net-leased properties to strong tenants or 2) highly discounted purchases of real estate from distressed or motivated sellers. That being said, we absolutely expect the commercial real estate market to continue to fall, and we want to be patient. We believe that we will see declines of at least 15-20% from current market prices. We see the next 2-3 years as an incredible buying opportunity, so we want to make sure that clients split their capital targeted for real estate into thirds or fourths and vest it over that time period into select, unique offerings that 1) take advantage of the downturn, 2) provide value-add strategies, 3) have seasoned operators/managers with a strong track record, 4) place the greed of the sponsor primarily after the return of our clients, 5) make reasonable conservative (even bearish) assumptions about their offering and the markets they operate in, and 6) continue to make discounted purchases throughout the downturn.

Oil: Long term, I am bullish on oil, but if the stock market crumbles as I expect and as the Dollar continues its mid-term rally, oil will face significant pressures and fall back at least below $50, in my estimation. If it does, I want to put as much as 10-15% of my personal net worth in the commodity (vested not all at once, of course) for the longer-term bull market that I believe oil will experience as India and China experience their own industrial revolutions. As for general client portfolios, 15% would be too much risk to have in basically one asset class, but building at least a 5-10% position in oil over the next 3-4 years would certainly be advisable. In each case, as listed above, you should be able to participate in 12-20+% return investments that do not include dry hole or completion risk and that assume flat commodity prices going forward--the expected difference being additional long-term upside.

As for Natural Gas, something bigger may be going on that is beyond my comprehension as Exxon seems to be making a large Natural Gas play (either that or they are simply buying a very good company?) in XTO. Nevertheless, I do not feel that I understand the supply and demand drivers for natural gas well enough to give a good opinion. My uneducated opinion is that there is more upside in oil in the long run, as that is an established world commodity, whereas natural gas is not as universally implemented. Moreover, I would note that we have vast domestic natural gas resources that may far outstrip near to medium-term demand, which would keep the price depressed. If you are considering Natural Gas investments, I would want to know that the investment still makes sense at $2-3 per MCF.

Gold: In my opinion, if you sleep better at night for having 5% of your net worth in gold, consider it currency insurance and go for it, but I believe that it is currently overvalued in the short run. I believe that we will see gold back below $800 eventually. Practically speaking, I still own physical gold, but only enough for a few months of a complete shutdown of our currency. Even so, I really don't think that people will want gold in a collapse--they will want food, water, and commodities that provide energy. In the long run, a small hedge of gold is not bad against the general deterioration of currency values, but as we are currently in a deflationary environment vs. inflationary environment, I think that gold may have topped out for the most part (with limited upside to $1,400 in the short run) and will not continue to rise until we see sustained inflation back in force. For the value investing/trading side, I held gold from $650 to $1000. I plan to pick a small portion back up somewhere under $800 if the context at the time makes sense. All of that being said, there is always a risk that gold finally decouples completely from the Dollar. In this case, gold would likely experience a blowout run and then bust in prices. I have no idea where that would take gold in terms of highs and lows if that were to happen. I would watch sentiment extremes to gauge the potential highs and lows along the way.

Currencies

Short-Term (within next 6 months): The EUR may rebound a bit more to work off the extreme lows reached this month. The Dollar, likewise, may continue to pause a bit from its recent rally and continue lower. GBP may strengthen, as there is a rebound in fiscal restraint for now, and AUS should strengthen against most currencies initially. (As of the editing of this letter, the EUR, USD, and GBP has probably experience a good amount of this move already, so I do not recommend taking positions in these more aged opinions).

Mid-Term (6-36 months): I believe that the Dollar will strengthen in keeping with the deflation theme. The EUR will weaken in keeping with the need for Europe to conduct quantitative easing (read:currency devaluation) to afford all of the crippling deficits that have been building up among member nations. The Renminbi will probably strengthen, as the Chinese have tremendous growth and opportunities ahead--without the larger burdens of debt carried by most other major currencies. The Renminbi also receives pressure from the US and domestic wage inflation to drive its value higher.

Long-term (36 months-10 years): Dollar strength may come to an end (much depends on how we handle our debt and control over resources and manufacturing bases), and it will be time to transition to currencies that are supported by larger manufacturing- and resource-based economies (such as AUS, CAD, and YUAN). Deflation will temporarily drive these other currencies lower in Dollar terms, providing significant opportunity in these other currencies that will enjoy long-term secular bull markets as the commodity resource boom takes off to fuel China and India's own industrial revolutions.That being said, this is somewhat dependent on how Canada and Australia handle their own housing bubbles (which exist and will pop and tempt them to weaken their currencies to soften the blow). I believe that the EUR will not be around in its current form in 10 years, and in general, I would like to continue shorting it for its potential demise.

Equipment Leasing: Some of the note programs that are collateralized by equipment make sense as an investment category, but their returns target 8-9% and are not really taking into account the major discounts in the market. Most equipment leasing equity plays are too risky, primarily due to the load the sponsors put on the offerings. I am working with some companies to develop a customized offering exclusively for our clients that allows investors to get a low-load, high-yield, higher-IRR investment that is collateralized by equipment. Yet even these efforts are predicated upon much lower equipment prices in the years to come as corporate demand slackens in light of a larger consumer slowdown.

Absolute Return Strategies

With regard to Commodity Trading Advisors, you are investing in a manager's ability to navigate certain markets or investments more than you are guessing at the valuations of specific assets or asset classes. The advice here is that you want advisors who have significant experience in both up and down markets, and you want to target multiple successful advisors in a portfolio rather than just one advisor. Another strategy you can use to minimize risk and maximize return in this sector is to select lower-return/lower-risk advisors with nominal leverage rather than higher-return/higher-risk advisors with no leverage.

Hedge Funds/Private Equity: This is almost as much of a manager investment as it is about the underlying investment collateral. That being said, there are some very good absolute return strategies that are not price dependent, as these strategies tend to be uncorrelated with almost every major asset class. Watch out, however, as this sector often employs significant leverage.

General Investment Plan

In summary, we believe that the opportunities over the next several years will be phenomenal. As a general investment plan to protect capital for the opportunities coming down the road, we are encouraging clients to keep 2/3 of their liquid wealth primarily in cash and cash-related investments (investment-grade bonds/treasuries,treasury-based money markets, etc.) during this deflationary period. Currently, and throughout the next 18 months to two years, we are having clients slowly deploy about 1/3 to 1/4 of their liquid investment capital into select income-producing, tangible asset value opportunities as well as certain absolute return strategies.

We will continue to work with clients to build diversified positions in most asset categories mentioned above as we see our targets met and as we see sentiment extremes reached within those categories. These are simply the general parameters: Specific offerings will still be reviewed individually to narrow options to the best fit for each client.

JRW News and Updates

This summer has been fairly busy for us! As of the writing of the last newsletter, we have hired a new client services and compliance account manager (May), and we are hiring two new due diligence analysts this week (Raymond and Stephen). We have had an influx of clients who are in 1031 exchanges (in excess of $18M in just under 3 months) and we continue to assist clients in placing retirement and investment funds into select assets and categories that I mentioned above. We are still tracking nearly every single conference call and property update that involves our clients and we are very close to launching a new website--one that will be interactive and allow for regular updates, posting of newsletters and educational materials, and a searchable database of client Q&As as well as our economic research.

It is our joy to serve our clients, so please let us know if there is anything we can do to better serve your needs. If you have any particular questions about this letter or other related topics, please feel free to contact me via email at jungerecht@jrwinvestments.com or on my office line at (877) 564-1031 ext. 112. If you would like to set up a phone or office appointment with us to go over specific investment opportunities, or if you would like one of my past newsletters or PowerPoints, feel free to contact Susana Dryden, our Director of Client Services, at clientservices@jrwinvestments.com or at her office extension of 144.

Best Regards,

Joshua Ungerecht

CEO and Chief Investment Officer